36+ what percent of income for mortgage

Web According to this rule a maximum of 28 of ones gross monthly income should be spent on housing expenses and no more than 36 on total debt service. The 2836 rule is a good benchmark.

How To Find Out If You Can Afford Your Dream Home

Take Advantage of Low VA Loan Rates.

. What More Could You Need. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Ad Calculate Your Payment with 0 Down.

Find The Right Mortgage For You By Shopping Multiple Lenders. Ad Competitive Interest Rates And No Private Mortgage Insurance Mean Lower Monthly Payments. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property.

Lock Your Mortgage Rate Today. In other words if your maximum. 28 of your income will go to your mortgage payment and 36 to all your other household debt.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. It Pays To Compare Offers. No more than 28 of a buyers pretax monthly income should go toward.

Apply Today and Get Pre-Approved In Minutes. Ad Compare Best Mortgage Lenders 2023. Lets say your total.

Web The 2836 model suggests that no more than 28 percent of your income be allocated to your mortgage payment and 36 percent to all other household debt. The 2836 rule is an addendum to the 28 rule. What More Could You Need.

Web By default 30-yr fixed-rate. Web The second part means that the total debt a household has should not exceed 36 percent of its income. Ad Were Americas Largest Mortgage Lender.

Find The Right Mortgage For You By Shopping Multiple Lenders. Web total household debt doesnt exceed more than 36 percent of your gross monthly income known as your debt-to-income ratio. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 1663 in. Web DTI less than 36. It Pays To Compare Offers.

Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Ad Were Americas Largest Mortgage Lender.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web The 36 should include your monthly mortgage payment. Lenders view a DTI under 36 as good meaning they think you can manage your current debt payments and handle taking on an additional loan.

This includes credit cards car loans utility. Web That may be state taxexempt. Lock Your Mortgage Rate Today.

Apply Online Get Pre-Approved Today. Total debt includes previously mentioned housing. Get All The Info You Need To Choose a Mortgage Loan.

Choose The Loan That Suits You. With that your other monthly debt should fit in under the overarching cap of 36. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

Web How much of your income should go toward a mortgage. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

How To Get A Mortgage Home Loan Tips

How Can People Afford 36 Of Their Gross Income On Mortgage Payments R Personalfinance

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Income To Mortgage Ratio What Should Yours Be Moneyunder30

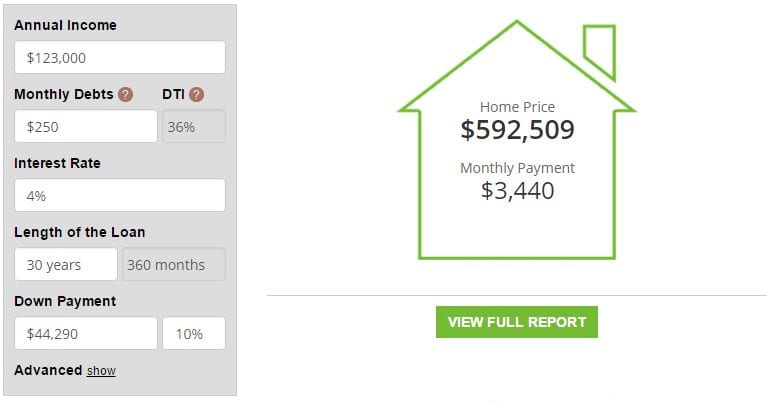

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Cities With The Highest Share Of Income Going Towards Mortgage Payments Hireahelper

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much House Can You Afford The 28 36 Rule Will Help You Decide

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

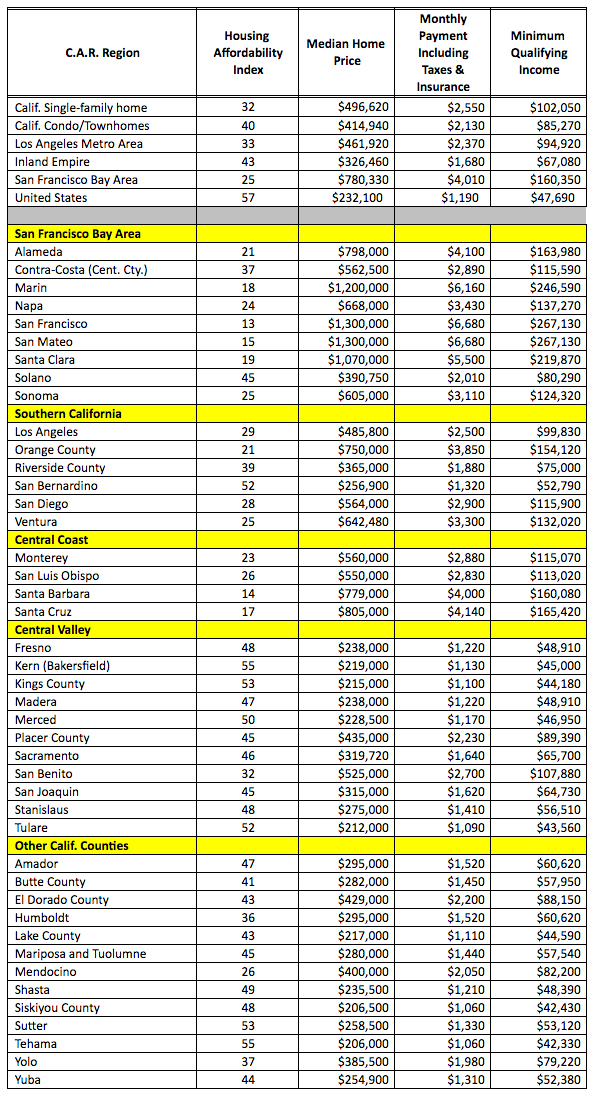

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Innovative Proptech Companies By Proptech Switzerland Issuu

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Solved Exhibit 9 8 Housing Affordability And Mortgage Chegg Com

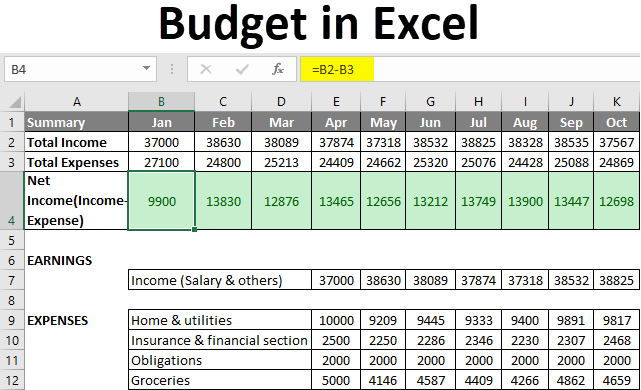

Budget In Excel How To Create A Family Budget Planner In Excel