Hourly rate calculator with taxes

Big on service small on fees. In addition your monthly pre-tax wage would be 333333 and your weekly pay would be.

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

The Australian salary calculator for 202223 Hourly Tax.

. Yes you can use specially formatted urls to automatically apply variables and auto-calculate. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. - In case the pay rate is hourly.

Payroll So Easy You Can Set It Up Run It Yourself. Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours. Ad Get Started Today with 2 Months Free.

Enter the number of hours and the rate at which you will get paid. You can enter regular overtime and one additional hourly rate. Your average tax rate is 270 and your marginal tax rate is 353.

Get Your Quote Today with SurePayroll. The Hourly salary calculator for Australia. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be.

Australia Hourly Tax Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

Subtract any deductions and. Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 2404 per hour. For instance an increase of.

All Services Backed by Tax Guarantee. Then enter the hours you expect to work and how much you are paid. Example annual salary calculation.

If you earn 40000 per year your hourly wage works out as being 1923 per hour. Enter your Hourly salary and click calculate. This marginal tax rate means that your immediate additional income will be taxed at this rate.

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table. For example if an employee earned an annual. For instance an increase of.

60163 per week 366. Using The Hourly Wage Tax Calculator. Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

There are two options in case you have two different. For example for 5 hours a month at time and a half enter 5 15. It can be any hourly weekly or.

As an example if you make 15 per hour and are paid for working 40 hours per week for 52 weeks per year your annual salary pre-tax will be 15 40. B Daily wage GP WPD C Weekly wage GP WPD WDW D Monthly wage E 12 E. Well run your payroll for up to 40 less.

Ad Run your business. With this in mind lets calculate the hourly rate for the average UK employee. Given that the second tax bracket is 12 once we have taken the.

For employees who are paid an annual salary gross pay is calculated by dividing their annual salary by the number of pay periods in a year. Get your payroll done right every time. This comes to 102750.

This number is the gross pay per pay period. Income qnumber required This is required for the link to work. Given that the first tax bracket is 10 you will pay 10 tax on 10275 of your income.

Ad Discover Helpful Information And Resources On Taxes From AARP. 31285 per year 52 weeks per year 60163 per week. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Your average tax rate is 217 and your marginal tax rate is 360. A Hourly wage is the value specified by the user within GP. First enter your current payroll information and deductions.

What Is Annual Income How To Calculate Your Salary

Self Employed Taxes How To Calculate Your Tax Payments Business Money Tax Money Advice

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Formats Samples Examples

Free Timesheet Templates Printable Simple 3 Step Solution To Getting Your Employees To Complete Time Timesheet Template Excel Templates Templates

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Payroll Taxes

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Formats Samples Examples

Pricing With Confidence Wedding Planner Pricing And Services Wedding Planning Worksheet Wedding Planning Business Wedding Planner

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Calculator Templates

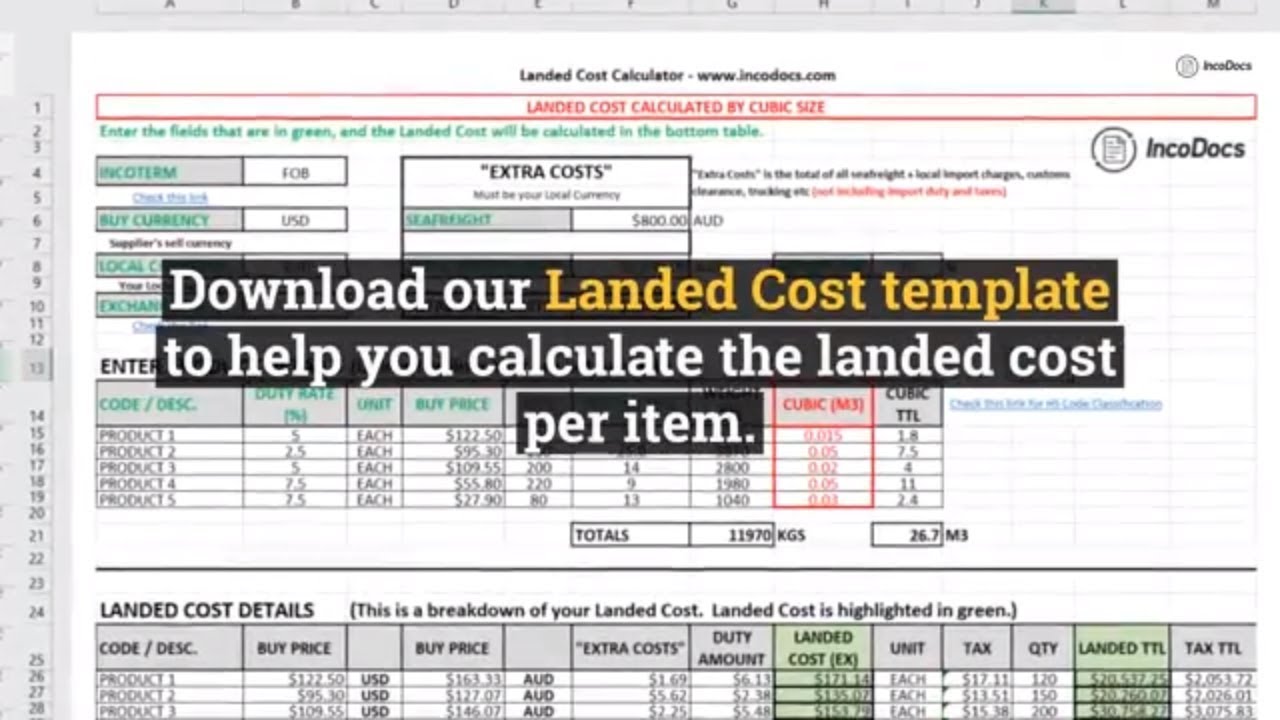

Calculate Landed Cost Excel Template For Import Export Inc Freight Customs Duty And Taxes Excel Templates Excel Verb Worksheets

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

How To Calculate The Hourly Cost Of A Pickup Truck Pickup Trucks Pick Up Cost

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator